Taking the First Step Toward Financial Freedom

Budgeting might sound complicated, but at its core, it’s just a plan for your money. If you’re just starting out, it’s okay to feel overwhelmed—but remember, you’re not alone. Millions of people are learning how to manage their finances every day. The good news? You don’t need to be a math genius or a financial expert to make it work. All it takes is a little time, consistency, and a willingness to be honest with yourself about your money habits. With the right approach, budgeting can actually feel empowering rather than restrictive.

Understand What You Earn and Spend

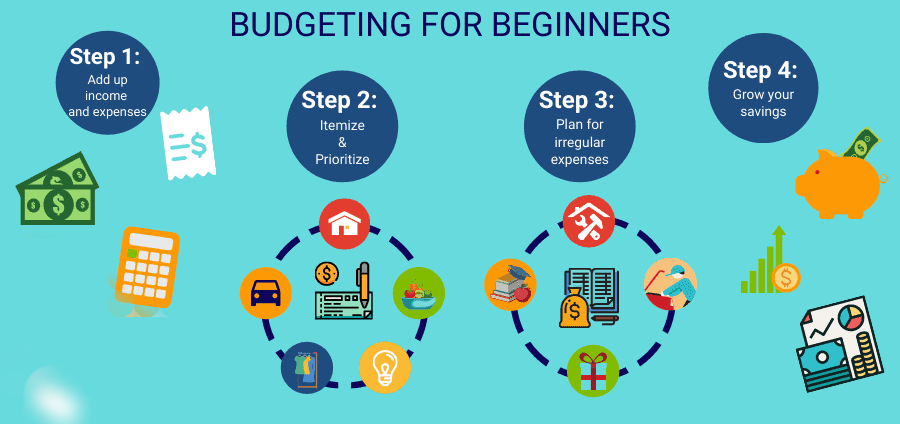

The first step to building a solid budget is understanding your cash flow—how much money comes in and how much goes out. This might seem basic, but you’d be surprised how many people don’t actually know where their money goes each month. Start by writing down your monthly income from all sources. Then list out every expense you can think of, both fixed (like rent or car payments) and variable (like groceries or entertainment). Don’t forget small expenses—they add up quickly. By seeing everything in one place, you’ll gain clarity and a starting point for improvement.

Build a Simple, Flexible Plan

Once you’ve mapped out your income and expenses, it’s time to create your actual budget. A good beginner budget doesn’t need to be perfect—it just needs to reflect your lifestyle. Begin by separating your spending into categories: essentials (like housing and food), financial goals (like savings or debt repayment), and flexible spending (like dining out or hobbies). Set limits for each category based on your priorities and income. Be realistic—cutting every fun activity isn’t sustainable. A balanced budget helps you live your life while also moving toward your goals. Use a notebook, spreadsheet, or app—whatever makes it easy for you to stick with.

Track Progress and Make Adjustments

Creating a budget is a great start, but sticking to it is where the magic happens. Throughout the month, track your spending to see how closely you’re following your plan. You can do this daily, weekly, or whenever works for your schedule, as long as it’s consistent. Don’t worry if things don’t go perfectly at first. Overspending happens. The key is to notice it, learn from it, and make adjustments. Maybe you under-budgeted for groceries, or didn’t realize how often you grab takeout. These insights help you create a more realistic budget next month. Budgeting is a process of progress—not perfection.

Budgeting for Beginners: Keep It Consistent

The most important thing to remember when it comes to budgeting for beginners is that consistency matters more than complexity. You don’t need a fancy tool or the perfect plan—you just need to keep showing up for your budget. As you get more comfortable, you can start setting short-term and long-term financial goals like building an emergency fund, paying off a credit card, or saving for a trip. The more you practice, the more natural it becomes. And as you see your finances improve, your confidence will grow too. Budgeting isn’t just about money—it’s about creating peace of mind and building a better future.